How does cryptocurrency work

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. https://generoustroopers.com/casino-mate/ This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

Price volatility has long been one of the features of the cryptocurrency market. When asset prices move quickly in either direction and the market itself is relatively thin, it can sometimes be difficult to conduct transactions as might be needed. To overcome this problem, a new type of cryptocurrency tied in value to existing currencies — ranging from the U.S. dollar, other fiats or even other cryptocurrencies — arose. These new cryptocurrency are known as stablecoins, and they can be used for a multitude of purposes due to their stability.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

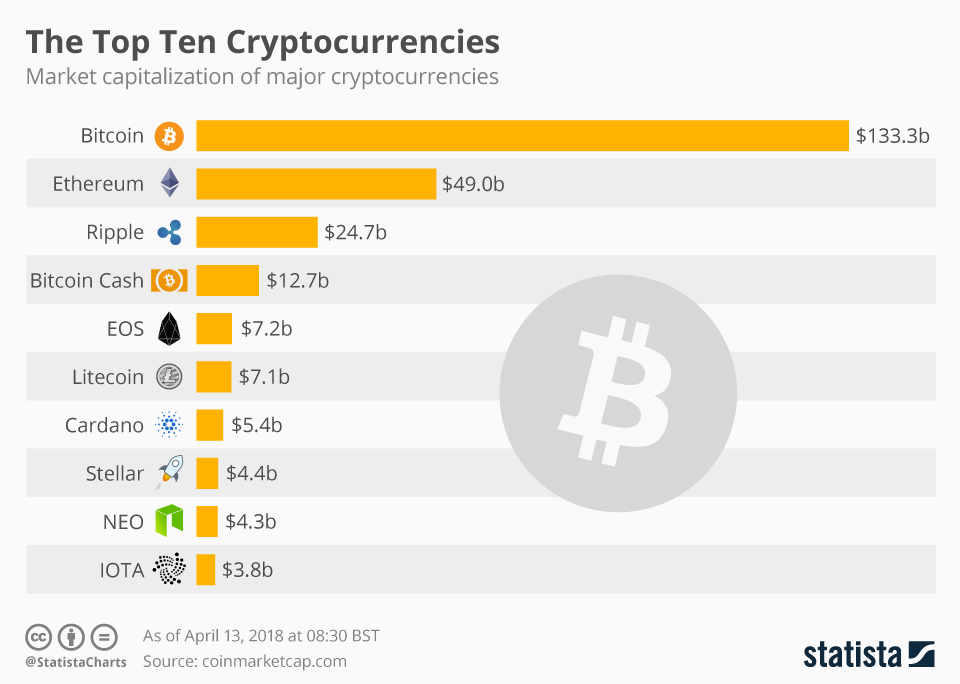

Top 10 cryptocurrency

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Like Tether, USD Coin (USDC) is a stablecoin, meaning it’s backed by U.S. dollars and aims for a 1 USD to 1 USDC ratio. USDC is powered by Ethereum, and you can use USD Coin to complete global transactions.

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. Are you interested in knowing which the hottest dex pairs are currently?

Pi cryptocurrency

Bitcoin’ distribution scheme, pictured below, further enforces this sense of scarcity. The Bitcoin block mining reward halves every 210,000 blocks (approximately every ~4 years.) In its early days, the Bitcoin block reward was 50 coins. Now, the reward is 12.5, and will further decrease to 6.25 coins in May 2020. Bitcoin’s decreasing rate of distribution means that, even as awareness of the currency grows, there is less to actually mine.

You do not need to leave the app open to mine. Pi does not affect your phone’s performance, drain your battery, nor use your network data any more than other regular apps. Once you hit the lightning button that initiates a new mining session and confirms your security circle, you can even close the app and you will continue to mine Pi. However, making diverse contributions to the network, such as using Pi apps, running computer nodes or inviting friends, will boost your mining rate. Any mobile usage of Pi apps will not consume more energy or resources than other regular mobile apps.

By comparison, the individual Pioneer base mining rate in the pre-Mainnet mining formula includes only system-wide base mining rate and Security Circle rewards. At Mainnet, a new component, lockup reward, is added to individual Pioneer base mining rate I. Lockup rewards L, along with the system-wide base mining rate B and Security Circle reward S, constitute the individual Pioneer base mining rate I. Since I is used as an input to calculate all the other rewards, as a result, the Security Circle and lockup rewards enhance the total Pioneer mining rate by: (1) by directly adding to the individual Pioneer base mining rate and (2) by boosting the any Referral Team reward E, nodes reward N, and app usage reward A.

Moreover, the Enclosed Network will allow the Mainnet to run with production data and real Pi, which differs from Testnet. Data gathered during the Enclosed Network will help calibrate and tweak any configurations and formulae, if necessary, to ensure a stable and successful Open Network.

Future of cryptocurrency

The Bank of England says its regulation would aim to “harness the potential benefits stablecoins could provide to UK consumers and retailers, in particular by making payments faster and cheaper” while working to protect consumers by preventing money laundering and safeguarding financial stability.

Regulators have the challenge and sometimes competing goals of keeping consumers safe while supporting the future of innovation. Striking the appropriate balance between consumer protection and innovation will require close collaboration between the industry and policymakers across jurisdictions due to the borderless nature of crypto.

To the diehard crypto utopians (and some crypto-anarchists), 2022 was not just another “crypto winter,” but more of an ice age. Along with a broad loss of confidence, economic value and a market littered with the tombstones of failed firms and projects, perhaps the era of crypto speculation will remain frozen in ice, giving way to a Cambrian explosion for responsible, always-on internet finance.

The World Economic Forum’s Digital Currency Governance Consortium (DCGC) has published research and analysis of the macroeconomic impacts of cryptocurrency and fiat-backed stablecoins. This work amplifies the need for timely and precautionary evaluation of the possible macroeconomic effects of cryptocurrencies and stablecoins and corresponding policy responses.

It is also important to note that the traditional international financial system requires significantly more energy than the Bitcoin network. All of the disparate parts that make up the whole of the global banking network – banking data centres, card network data centres, ATMs and bank branches – use a lot of energy. In fact, the traditional financial sector provides financing for some of the most environmentally damaging projects on Earth.